Describe the Three Main Techniques Used to Manipulate Revenue

Manipulation of adjustments to revenues Fictitious Revenues The most egregious forms of. A record of financial activity that is suitable for a variety of users to properly assess the financial health of.

5 Ways Writers Use Misleading Graphs To Manipulate You Infographic Venngage

The following top selling sales techniques are built on those principles.

. Some of the principle means of managing earnings are cookie jar reserves capitalization practices big bath losses altering the timing of operations to speed recognition of revenues aggressive merger and acquisition practices and revenue recognition practices. The customer can be another company B2B or a consumer B2C. Describe the three main techniques used to manipulate revenue.

The price of the product or service constitutes the production costs and margin. What is meant by the term revenue cycle. IDeaS another popular automated solution for revenue management pricing forecasting and reporting.

When valuing a company as a going concern there are three main valuation methods used by industry practitioners. GAAP company management must therefore utilize conservative estimates and judgments. What is an aging schedule.

Try them out to see which one fits your business. Premature revenue recognition. By using exploratory statistical evaluation data mining aims to identify dependencies relations patterns and trends to generate advanced knowledge.

Three main types of revenue manipulations are. All-Purpose Financial Statement. C Defining the transaction types to be tested.

Students also viewed these Auditing questions Describe the three main components of product cost. However companies flexibility in revenue recognition creates the. Cancellation No Show ratio Benefits of Hotel Market Segmentation.

The following points highlight the three major tools used by government to influence private economic activity. Completion of Earnings and Assurance of Payment With the completion of earnings method the seller must not have a remaining obligation to the customer. Another reason revenue is susceptible to manipulation is the difficulty of determining the appropriate timing of revenue recognition in many situations.

The major steps to be undertaken by the cost auditor in the application of a CAAT in performing cost audit under EDP environment are as follows. A sales technique or selling method is used by a salesperson or sales team to create revenue and help sell more effectively. The revenue is generated by directly selling an item or a service to a customer.

Denials require additional work and hence cost at the billing organization Denials delay the receipt of payment which increases the cost of carrying the receivables balance If the denial is permanent the claim is never paid and the cost of service is borne by the provider. A Setting the objective of the CAAT application. Duetto industry-leading cloud-based revenue management software featuring three main modules.

All of these things provide companies with the information required to track revenue performance and build out strategies to optimize revenue. On the sales side use. The market segmentation helps in identifying the trends of your business that allow your hotel to increase your revenue performance.

What are the three sets of activities that comprise the revenue cycle. There are 3 things that feed into revenue optimization. Total Revenue per Room Total Revenue per Client.

Regression analysis Regression Analysis Regression analysis is a set of statistical methods used to estimate relationships between a dependent variable and one or more independent variables linear programming and data mining. Your marketing and sales teams need to be aligned. Up to 5 cash back Revenue Manipulation Revenue recognition cannot be performed completely accurately and under US.

Day of Weeks stays. Which revenue source to prioritize understanding target customers and how to price their products. Shifting Current Revenue to a Later Period.

Common revenue models include subscription licensing and markup. What is the overall goal of revenue cycle management. Changing accounting assumptions to foster manipulation.

Creating a rainy day reserve as a revenue source to bolster future performance. A revenue management system or RMS is a software solution which allows you to more easily perform various revenue management-related tasks. Define the term average collection period ACP.

Use Your Marketing Team. Increasing the margin the business is able to generate more income from sales. Quantitative Analysis Techniques.

Marketing automation sales efficiency and proper data collection. B Determining the content and accessibility of the entitys files. Theres so much these two departments can learn from each other to help the organization reach its main goal of generating more revenue.

How is ACP used to monitor overall revenue cycle performance. What is a sales technique. A method of data analysis that is the umbrella term for engineering metrics and insights for additional value direction and context.

There are five primary methods a company can use for revenue recognition. - Selection from Crash Course in Accounting and Financial Statement Analysis. What are the Main Valuation Methods.

GameChanger to support pricing and segmentation ScoreBoard for advanced reporting and BlockBuster for contracted-business optimization. 1 DCF analysis Financial Modeling 2 comparable company analysis and 3 precedent transactionsThese are the most common methods of valuation used in investment banking Investment Banking Investment banking is. The software can make use of data you input as well as wider industry data and perform real-time analysis of the state of your business and your current financial performance.

Claims denials increase revenue cycle costs in three ways. The revenue model helps businesses determine their revenue generation strategies such as. It encompasses three main techniques of measuring data.

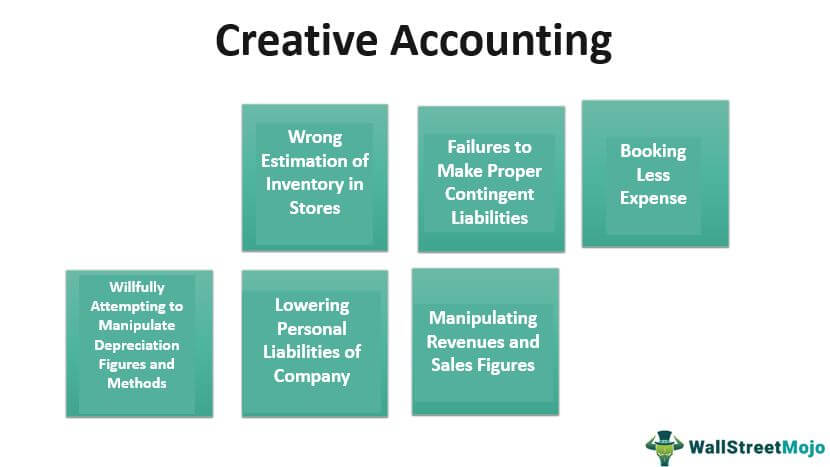

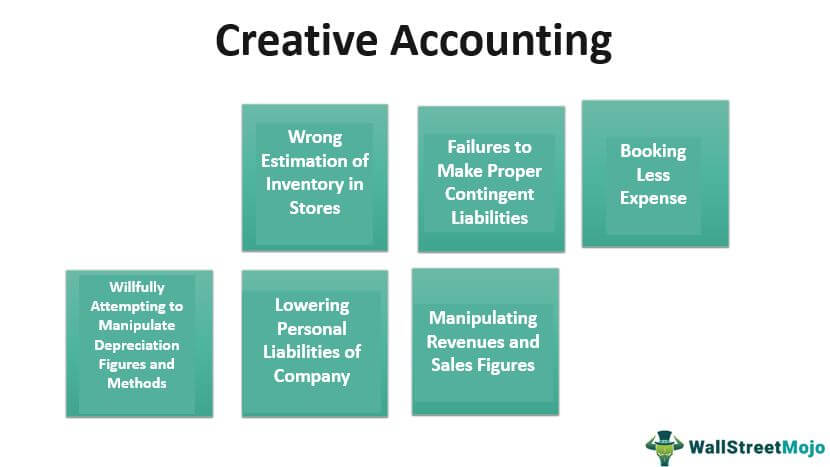

Creative Accounting Meaning Examples Top 6 Methods

Financial Statement Manipulation Overview Reasons Factors

/bonds-lrg-4-5bfc2b234cedfd0026c104ea.jpg)

Financial Statement Manipulation An Ever Present Problem For Investors

Comments

Post a Comment